This post is part of a social shopper marketing insight campaign with Pollinate Media Group® and Payoff, but all my opinions are my own. #pmedia #payoffmindset #whatsyourpayoff http://my-disclosur.es/OBsstV

A new year is a fresh start. Some of my goals this year are to get healthy and fit, not only physically but fiscally too. I’d like to work on saving more and spending less. It’s so easy to rack up charges on a credit card, and there’s nothing worse than getting an unexpectedly large statement in the mail that you are unable to pay.

A new year is a fresh start. Some of my goals this year are to get healthy and fit, not only physically but fiscally too. I’d like to work on saving more and spending less. It’s so easy to rack up charges on a credit card, and there’s nothing worse than getting an unexpectedly large statement in the mail that you are unable to pay.

We have online bill pay through our bank, and just the other day I decided to schedule all of those important bills that have a set amount, like the mortgage for instance, and our home improvement store credit card that I pay down each month. This helps me out a lot, because these are the bills that I get penalized heavily for when I’m late paying them. Those fees add up!

Pay off credit card balances

What would you do after paying off your credit card bills? Payoff.com can help you achieve your goals. We don’t carry large balances on any credit cards unless we’re taking advantage of a zero percent financing offer, but we still hate having those extra balances hanging over our heads. This year, we plan on taking at least one vacation, working on home improvement projects, and adding to our retirement and education savings accounts.

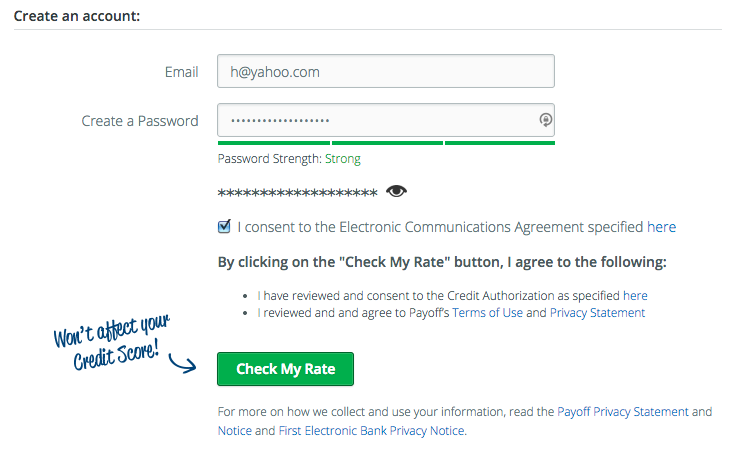

Payoff.com aims to help customers pay off credit card debt in the best, most safe way possible. My husband is always cautious about sharing personal information on the internet, so it’s very important to make sure you’re doing this on a safe encrypted site.

Payoff.com aims to help customers pay off credit card debt in the best, most safe way possible. My husband is always cautious about sharing personal information on the internet, so it’s very important to make sure you’re doing this on a safe encrypted site.

I recently went through the application process on Payoff.com just to see what it was all about. You must have between $5,000 and $25,000 in credit card debt for this program. Unfortunately, the company does not lend to residents of New Jersey.

I love that there are other areas of the site to help you get a handle on your spending and savings habits. It’s important to get to know yourself before you can get financial matters in order. For more great tips, visit Payoff.com on facebook.

I love that there are other areas of the site to help you get a handle on your spending and savings habits. It’s important to get to know yourself before you can get financial matters in order. For more great tips, visit Payoff.com on facebook.

We are working to pay off the credit card debt we accumulated while we were going to school. Now that we are both done we can start that process as well as tackle those student loans.

Thank goodness I don’t have any credit card debt. Kind of weird to have a loan to pay off your debt…

Great post! My husband just started using something like this. It’s some new kind of software that’s similar to Payoff that his work is giving people subscriptions to.

Finding little ways to streamline income adds up big. It’s wonderful that you’ve provided a resource here to help do that for folks.

I am trying to pay off medical bills from car accident and my daughter’s illness.

I am working to increase my savings in 2015. I would like to pay off some debts too.

Oh I like that, I know someone who needs this now!

I am not familiar with Payoff.com, definitely sounds like a great resource. We are working on paying off big ticket items ourselves this year.

I have my house mortgage and no other debt aside from monthly bills. I may need to purchase a new car this year so I’m not looking forward to another bill.

Thank God, I have zero credit card debt. And I prefer not to get a loan to pay off another loan